ICMS Exemption for Sales to Free Trade Areas (FTAs)

São Paulo State Decree No. 70,348/2026 introduces a temporary ICMS exemption for sales of domestic industrialized or semi-finished goods to specific Free Trade Areas (FTAs). The measure is retroactive to 29 December 2025 and remains effective until 30 September 2026. Scope and Eligibility The exemption applies to sales destined for resale or industrial processing by […]

New Law on Income and Dividend Taxation: Impacts on Non-Residents and Cross-Border Remittances

The new Brazilian income tax law is now in force, effectively reinstating the withholding tax (WHT) on dividend distributions, including all remittances abroad. This measure, long anticipated by the market, significantly impacts non-resident investors and multinational structures. Our team has prepared a complete e-book with details about the new legislation.

M&A Activity in Brazil Rebounds, Technology Leads 2025 Deal Volume

The Brazilian mergers and acquisitions (M&A) market experienced a robust rebound in 2025. Despite facing persistent global headwinds, the market has demonstrated resilience and continued to expand its deal volume, reinforcing Brazil’s leading position in Latin America. According to TTR Data Brazil (TTR), Brazil recorded about 1,142 transactions totaling roughly BRL 187.8 billion through August […]

REDATA – Special Regime for Data Centers Established by Interim Measure 1,318/2025

On September 18, 2025, the Federal Government issued Interim Measure (MP) No. 1,318/2025 in the Federal Official Gazette, creating the Special Tax Regime for Data Center Services (REDATA). The goal is to encourage the installation, expansion, and modernization of Brazil’s digital infrastructure, fostering innovation, cost reductions, and stronger digital sovereignty. The measure amends Law No. […]

Brazilian Federal Revenue Service Aligns Fintechs with Financial Institutions for Tax Reporting

On August 28, 2025, the Brazilian Federal Revenue Service (RFB) issued Tax Directive No. 2,278, marking a significant regulatory convergence in the digital finance sector. The rule effectively mandates that fintechs and payment institutions are treated as financial institutions for purposes of information reporting, specifically via the e-Financeira electronic system. This measure brings entities operating […]

Litigation Volume Rises, Projected to Hit New Post-2017 Record in 2025

The volume of claims filed in Brazil’s Labor Courts continues its upward trajectory and is projected to reach its highest level since the 2017 Labor Reform in 2025. This surge is primarily driven by the services sector. In 2024, approximately 2.1 million lawsuits were filed—the largest total since the Reform’s enactment. After a post-Reform low […]

STJ Sets Objectives Parameters for Collective Environmental Moral Damages

The Superior Court of Justice (STJ), through its First Panel, has taken a significant step toward systematizing the assessment of collective environmental moral damages. While the STJ previously recognized this form of non-pecuniary harm, the recent ruling sets objective parameters, injecting predictability into the recognition and quantification of this diffuse interest injury. The Court established […]

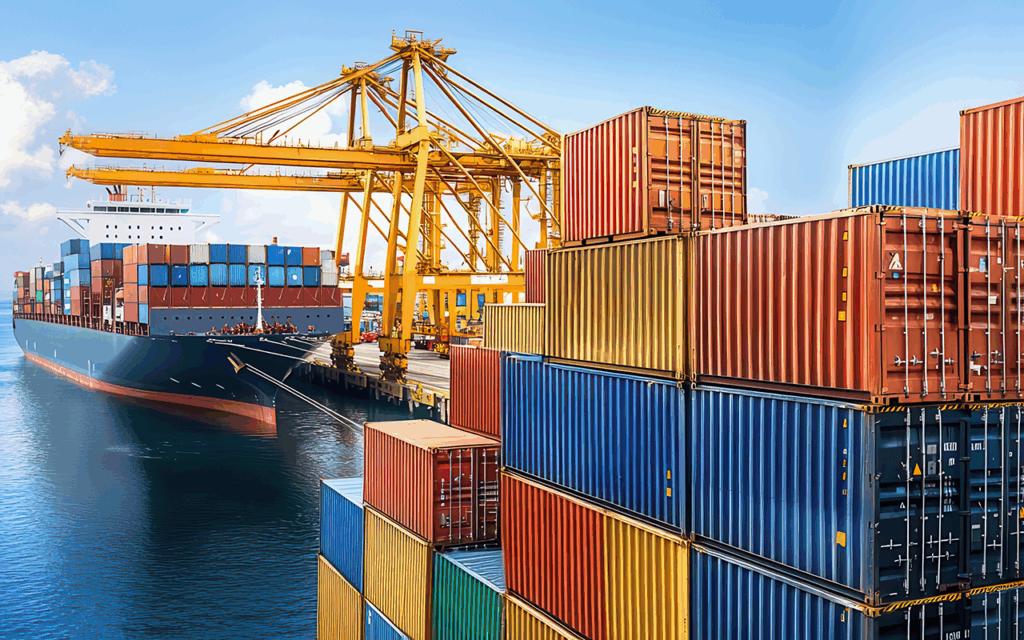

Drawback Services: What Changes Under SECEX Ordinance No. 418/2025

The Ministry of Development, Industry, Trade and Services (MDIC), through the Secretariat of Foreign Trade (SECEX), has issued SECEX Ordinance No. 418/2025, regulating the introduction of Drawback Services. This new rule amends the existing Drawback Suspension regime (established under SECEX Ordinance No. 44/2020) to extend the tax benefit to service contracts related to exports, moving […]

STJ Reviews Legality of Additional 1% Cofins-Importation on Zero-Rated Goods

The Superior Court of Justice (STJ) has recently referred Theme 1,380 to its repetitive-appeals docket, raising new questions about the legality of the additional 1% Cofins-Importation surcharge under Article 8, paragraph 21, of Law No. 10,865/2004. This dispute particularly impacts goods subject to a zero-contribution rate. Unlike Theme 1,047, decided by the Federal Supreme Court […]

Brazil’s Lower House Approves Income Tax Reform: Exemption up to BRL 5,000, New Tax on High Incomes

On Wednesday evening, 1 October, the House of Representatives approved the report presented by Arthur Lira on Bill No. 1087/25. The proposal exempts individuals earning up to BRL 5,000 per month from income tax and, as a compensatory measure, introduces taxation on earnings above BRL 50,000 per month or BRL 600,000 per year. The approved […]