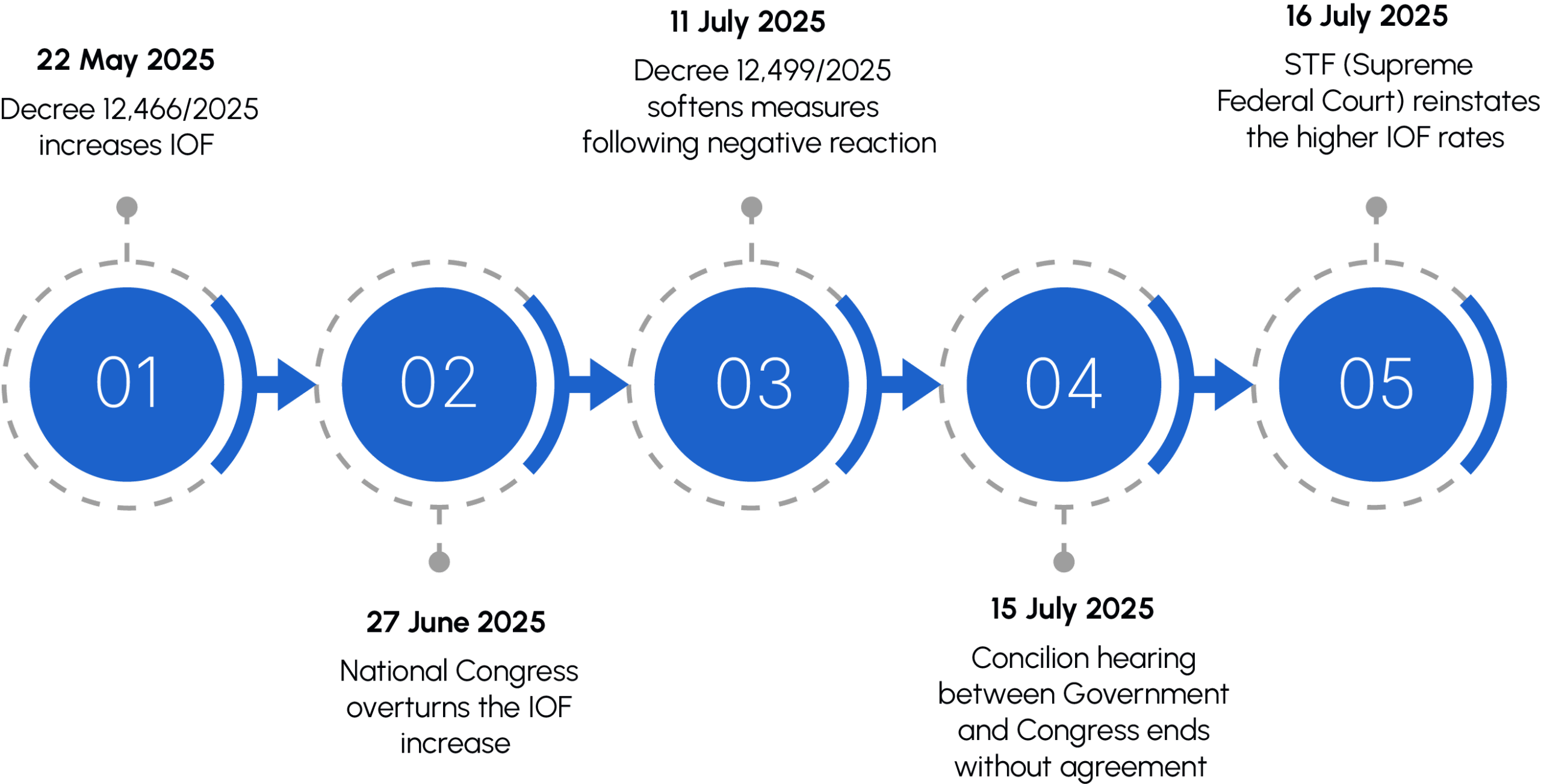

On 16 July 2025, Justice Alexandre de Moraes partially upheld the constitutionality of Decree 12,499/2025 and reinstated the higher Tax on Financial Transactions (IOF) rates, reversing Congress’s 27 June 2025 decision to overturn them.

The measure followed a conciliation hearing between the Executive and Legislative Branches convened by the Justice, which ended without agreement. The Supreme Federal Court then decided the matter.

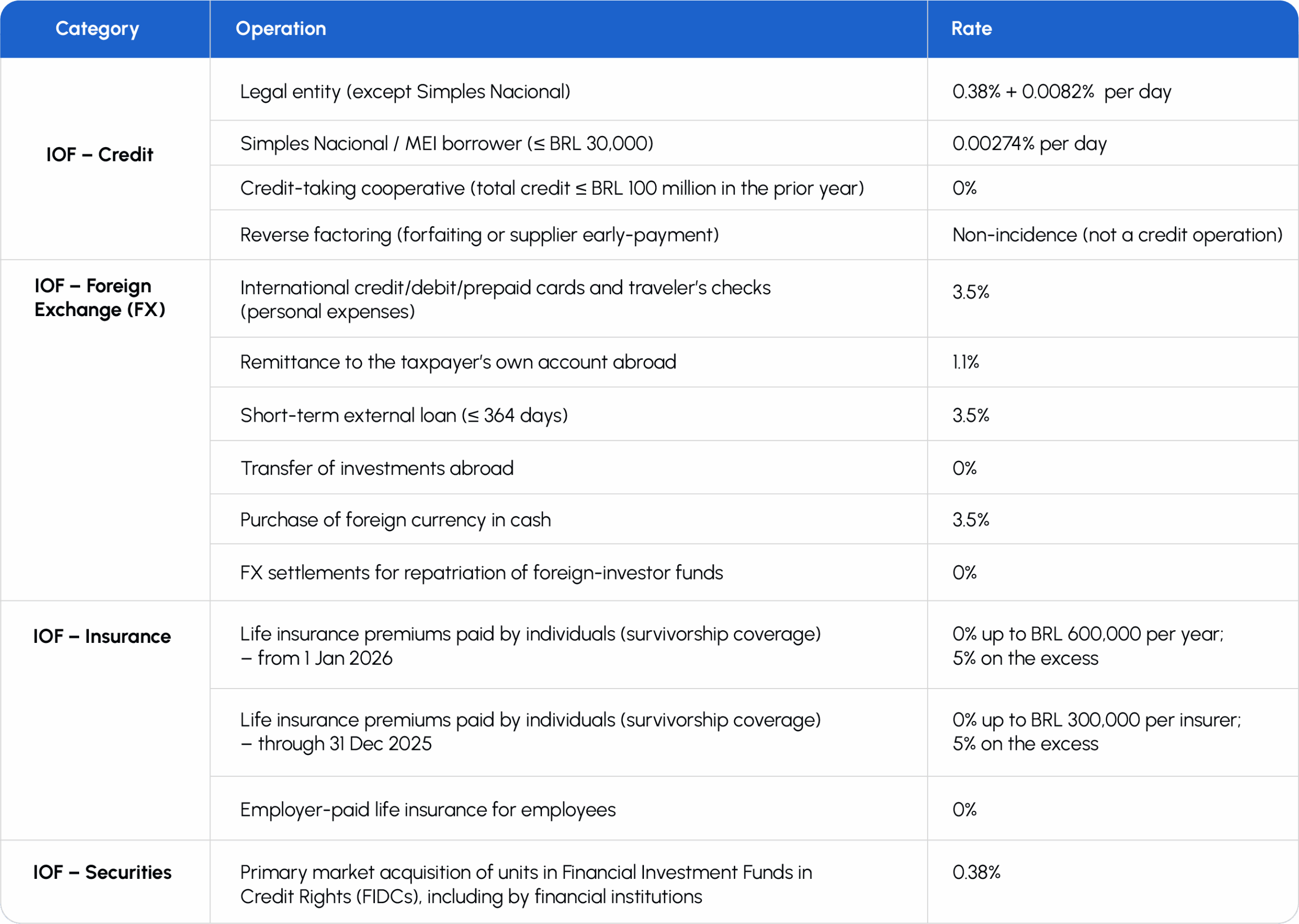

The decision, which partially reinstates Decree 12,499/2025, unifies rates across several categories of financial transactions. The exemption for reverse factoring (buyer-led supply chain finance) arrangements was preserved, as those transactions are not treated as credit operations.

The ruling has retroactive effect: the new rates also apply to transactions carried out on or after 27 June 2025, the date of the prior suspension.

The case was decided in Action for a Declaratory Judgment of Constitutionality (ADC) 96 and Direct Constitutional Challenges (ADIs) 7,827 and 7,839. The outcome has immediate effects on consumers and companies, affecting transactions from international purchases to short-term loans.

The Federal Government first proposed higher IOF rates in May 2025 as a revenue-raising measure. Official estimates projected more than BRL 20 billion in 2025 and over BRL 40 billion in 2026.

However, given the current framework and the continued exemption for reverse factoring (buyer-led supply chain finance) arrangements, the Government now projects a revenue shortfall of approximately BRL 450 million in 2025 and BRL 3.5 billion in 2026. These figures partially offset the expected upside from higher IOF rates and underscore the challenge of balancing revenue objectives with legal certainty in tax policy.

After a period of volatility and the Supreme Federal Court’s recent decision, the IOF rates have been reset under Decree 12,499/2025. The decision takes immediate effect but remains subject to confirmation by the Court’s full bench, so further adjustments may follow.

See the updated details below:

For the decision and decrees, see:

Glossary:

Tax on Financial Transactions (IOF): federal tax on credit, foreign-exchange, insurance, and securities transactions; rates set by decree.

Reverse Factoring (buyer-led supply chain finance): arrangement in which the buyer initiates early payment to suppliers through a financier; for IOF, not treated as a credit operation (non-incidence).

Action for a Declaratory Judgment of Constitutionality (ADC): proceeding asking the STF to confirm a statute’s constitutionality with nationwide effect.

Direct Constitutional Challenge (ADI): proceeding asking the STF to strike down a statute or decree as unconstitutional, with nationwide effect.

Simples Nacional: simplified national tax regime for small businesses.

Individual Microentrepreneur (MEI): simplified individual business category within Simples Nacional.

Financial Investment Funds in Credit Rights (FIDCs): securitization funds that invest in receivables (credit rights); IOF applies on primary market acquisitions.