On 18 March 2025, the Brazilian Federal Government submitted Bill No. 1,087/2025 to the National Congress. It proposes an income tax exemption for individuals earning up to R$5,000.00 per month. Additionally, it introduces a minimum income tax (IRPFM) targeting high-income individuals, introducing a progressive rate that applies to monthly incomes above R$50,000.00, reaching up to 10% at R$100,000.00.

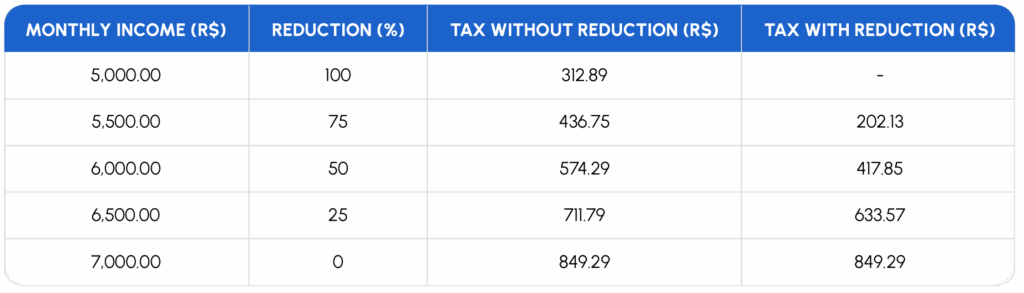

Beyond expanding the income tax exemption threshold, Bill No. 1,087/2025 also proposes a gradual reduction in tax rates for individuals earning between R$5,000.00 and R$7,000.00 per month.

The existing income tax brackets remain unchanged, with progressive rates of 7.5%, 15%, 22.5%, and 27.5%. The proposed deductions would apply after the standard rates have been applied.

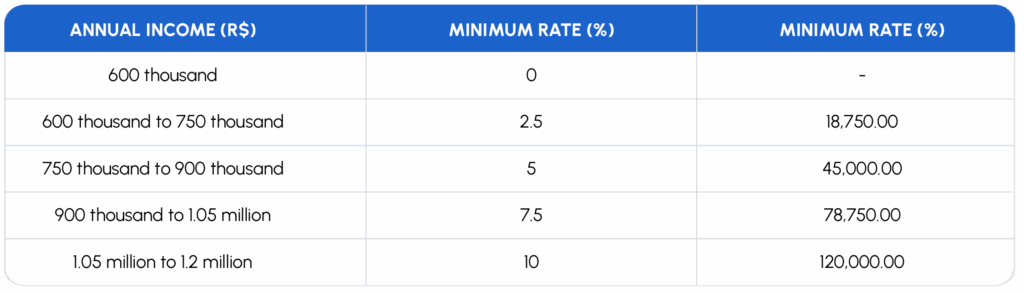

The minimum tax for high-income individuals also features a progressive rate structure, affecting those with monthly incomes above R$50,000.00.

The proposed minimum tax takes into account amounts already paid throughout the year. For example, a taxpayer with annual income of R$1.2 million who has paid 8% in income tax would be required to pay an additional 2% to reach the 10% minimum rate.

The potential impact of Bill No. 1,087/2025—if approved—on investment vehicles such as Real Estate Receivables Certificates (CRIs), Agribusiness Receivables Certificates (CRAs), Real Estate Investment Funds (FIIs), and Investment Funds in Agribusiness Chains (Fiagro) may raise concerns.

To determine annual income, the taxpayer must add all income received throughout the year—including wages, rental income, dividends, and other earnings. If the total exceeds R$600,000.00, the progressive minimum tax rate would apply. However, specific types of income must be excluded from the taxable base when calculating the final amount due.

Finally, as provided in Article 16-B of Bill No. 1,087/2025, if the combined effective tax rate on corporate profits and the new minimum tax on individual high income exceeds 34% (the standard combined rate of Corporate Income Tax – IRPJ – and Social Contribution on Net Profit – CSLL), a reduction will be granted on the individual taxpayer’s liability to ensure alignment.

If enacted, Bill No. 1,087/2025 would take effect on 1 January 2026.

Glossary – Tax

Administrative Council of Tax Appeals (Carf) – Brazilian administrative tribunal responsible for resolving tax disputes between taxpayers and the federal government.

Brazilian Development Bank (BNDES) – State-owned financial institution that provides long-term funding for investment projects in Brazil.

Corporate Income Tax (IRPJ) – Federal tax on corporate profits in Brazil.

Actual profit regime (lucro real) – Brazilian tax regime under which corporate income tax is calculated based on accounting profit, adjusted by tax additions and exclusions.

Brazilian Federal Revenue Service (RFB) – Government body responsible for tax administration, collection, and enforcement in Brazil.

Tax Directive No. 1,700/2017 – Normative instruction issued by the RFB detailing rules for calculating corporate taxes.

Finep (Funding Authority for Studies and Projects) – Public agency that finances innovation and research-related projects in Brazil.

Social Contribution on Net Profit (CSLL) – Federal tax levied on a company’s net profit, in addition to IRPJ.

Law No. 14,789/2023 – Brazilian law providing rules on the taxation of subsidies and incentives, effective as of 2024.

Bill No. 1,087/2025 – Proposed legislation introducing changes to personal income tax brackets and the creation of a minimum tax for high-income individuals.

Minimum income tax (IRPFM) – Proposed tax mechanism that sets a minimum effective tax rate for high-income individuals, regardless of the source of income.

Receivables Certificates – Fixed-income instruments backed by real estate (CRI) or agribusiness (CRA) receivables.

Real Estate Investment Funds (FIIs) – Investment vehicles focused on income-generating real estate assets.

Investment Funds in Agribusiness Chains (Fiagro) – Funds designed to channel investments into agribusiness production chains.