Brazil’s tax reform took a concrete step toward implementation. As of 1 July 2025, the Consumption Tax Reform pilot program is in effect under RFB Administrative Ordinance 549, dated 13 June 2025. This initial phase is designed to validate systems and processes for the new Contribution on Goods and Services (CBS) and gives companies an early window to align with the new tax model and begin a structured transition.

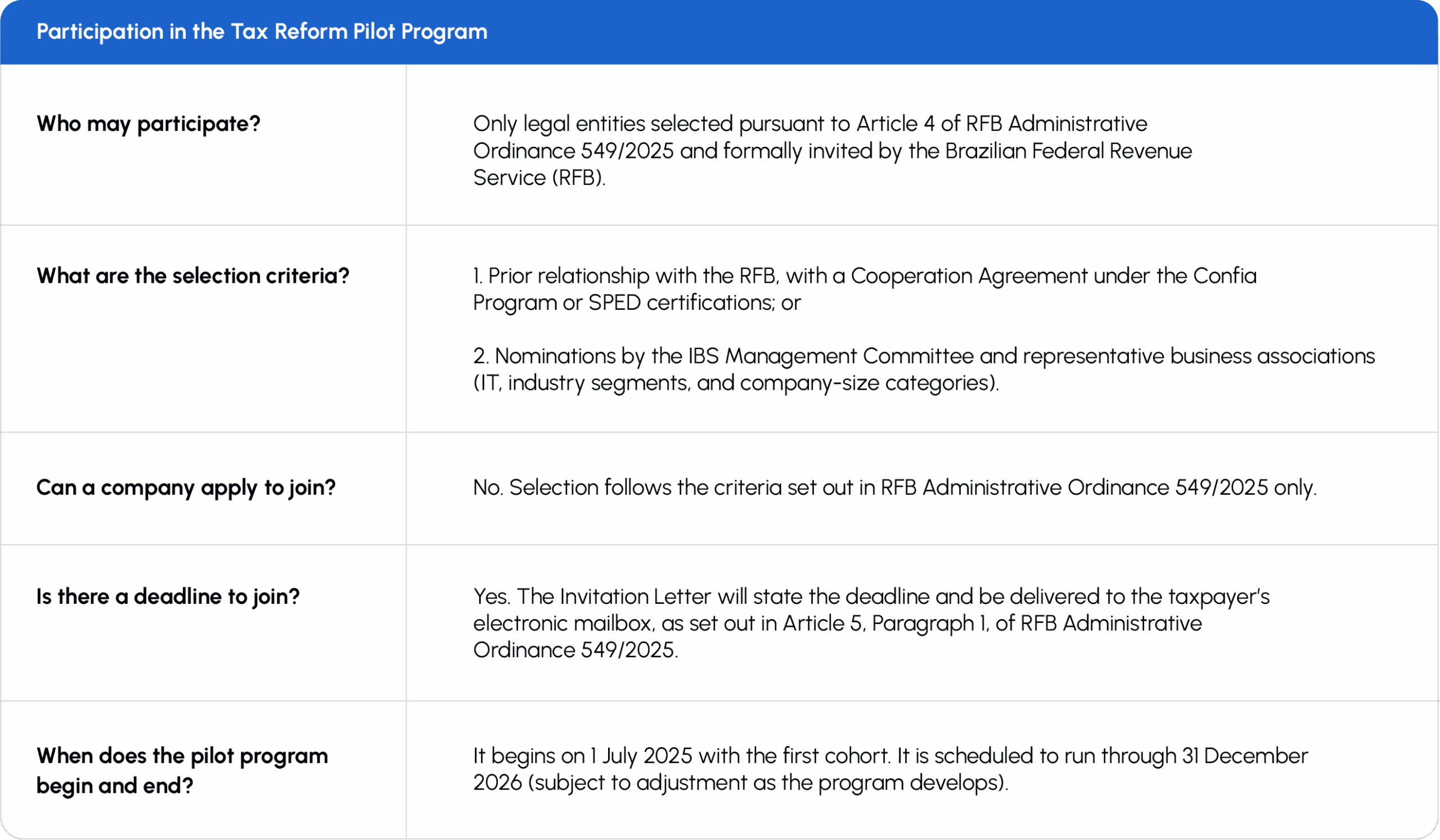

In practice, CBS systems and processes are in use at 500 selected companies. Selection was based on technical and institutional criteria, economic representativeness, and sector and size diversity. The roster is being formed exclusively through nominations from nationwide business bodies, including confederations, federations, and sector associations.

The first list – companies with a prior relationship with the RFB – was published on 27 June 2025. Invitations to additional participants will be issued gradually as testing advances. The timetable runs from 1 July 2025 through 31 December 2026.

Benefits of participating in the pilot

Participation offers strategic advantages. Being among the 500 selected companies provides early access to CBS solutions, the chance to test tools, provide feedback, and prepare with greater certainty for the definitive rollout from 2027.

Additionally, participants will have direct access to the Brazilian Federal Revenue Service (RFB) and the Federal Data Processing Service (Serpro), creating a channel for operational feedback and faster clarifications. Their early involvement enables timely detection of potential system inconsistencies, reduces migration risk to the new model, and increases predictability throughout the transition.

Accordingly, joining the pilot program signifies institutional recognition and positions the participant as an early mover in innovation and tax compliance from the outset.

Glossary:

Brazilian Federal Revenue Service (RFB): Brazil’s federal tax authority; administers federal taxes and issues sub-regulatory acts.

RFB Administrative Ordinance: RFB regulatory instrument (Portaria) used to implement and coordinate programs; distinct from a Tax Directive (Instrução Normativa).

Contribution on Goods and Services (CBS): new federal value-added tax that will replace PIS/COFINS under the reform.

Federal Data Processing Service (Serpro): Brazil’s federal IT and data-processing agency that supports RFB systems.

Confia Program: RFB cooperation program with taxpayers; participation/agreements can be a selection criterion in the pilot.

Public Digital Bookkeeping System (SPED): national platform for digital accounting and tax filings used by companies in Brazil.

IBS Management Committee: governance body for the new Tax on Goods and Services (IBS) that coordinates the transition and may nominate participants.

Taxpayer’s Electronic Mailbox: the taxpayer’s official digital inbox for notices from the RFB (delivery point for the Invitation Letter).