On September 18, 2025, the Federal Government issued Interim Measure (MP) No. 1,318/2025 in the Federal Official Gazette, creating the Special Tax Regime for Data Center Services (REDATA). The goal is to encourage the installation, expansion, and modernization of Brazil’s digital infrastructure, fostering innovation, cost reductions, and stronger digital sovereignty.

The measure amends Law No. 11,196/2005, which governs technology incentive regimes, and will be in effect for five years. Participation in REDATA is voluntary and subject to qualification by interested companies. It also permits the co-qualification of legal entities engaged to perform activities related to data center operations.

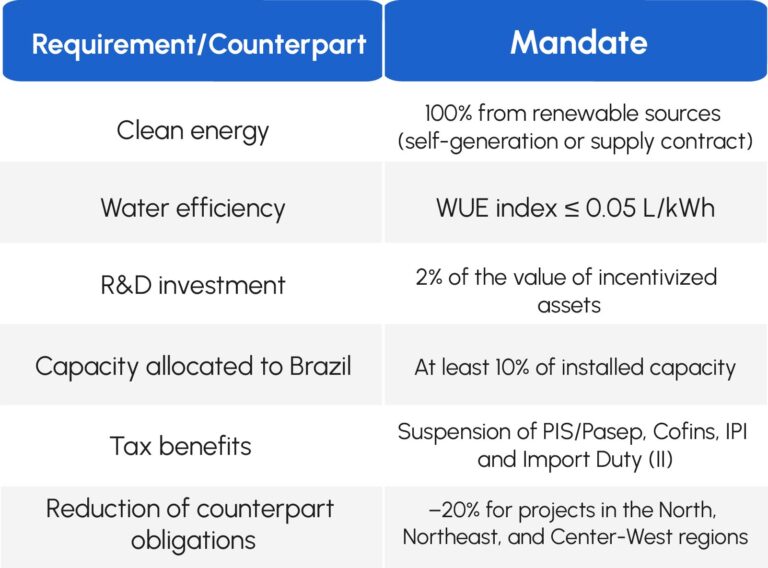

Key Requirements and Counterpart Obligations

Companies must meet specific criteria, which include technical sustainability standards:

In addition, companies must comply with technical sustainability standards, including the exclusive use of clean energy, stringent water-efficiency benchmarks, and—depending on project size and location—environmental licensing and water-use concessions.

Tax Benefits

The Interim Measure suspends the following taxes on domestic purchases or imports of ICT equipment allocated to the fixed assets of data centers:

- Import Duty (II) (for equipment with no national equivalent).

- Excise Tax on Industrialized Products (IPI).

- The federal social contributions: PIS/Pasep and Cofins (including on imports).

Once the commitments are fulfilled and the assets are permanently incorporated, the suspension is converted to a zero-tax rate.

Impacts and Strategy

The Federal Government estimates that REDATA will generate approximately BRL 5.2 billion in tax incentives by 2026. The Brazilian Federal Revenue Service projects foregone revenue of BRL 5.2 billion in 2026, BRL 1.0 billion in 2027, and BRL 1.05 billion in 2028.

The measure also seeks to reduce external dependence, as roughly 60% of Brazilian data is processed abroad. According to the Ministry of Finance, operating data centers in Brazil is, on average, 30% more expensive than in other jurisdictions, largely due to the tax burden.

Interactions with Other Regimes

REDATA is designed to coexist with other incentive regimes, such as the one created by Interim Measure No. 1,307/2025 for projects in Export Processing Zones (ZPEs). While ZPE incentives generally offer broader tax benefits, they also impose stricter operational obligations. Therefore, the choice between regimes requires a careful consideration of the specific project profile, location, and overall business model.

Energy and Sustainability

A notable aspect of REDATA is its sustainability requirement. Unlike Interim Measures Nos. 1,300/2025 and 1,307/2025, REDATA does not require the sourcing of power from new power-generation projects. However, it strictly maintains the mandate of the exclusive use of clean or renewable sources. Given the inherent intermittency of solar and wind power, this condition presents technical challenges to implement structural solutions to ensure continuous and reliable supply.

Legislative Procedure

The Interim Measure took effect upon publication and is initially valid for 60 days, extendable once for an additional 60 days. If not voted on within 45 days, it proceeds under an urgency procedure. If the Interim Measure fails to be converted into permanent law within its total validity period, it will lapse and its effects will be suspended.

Access the official text of Interim Measure No. 1,318/2025

Glossary

Interim Measure (Medida Provisória) – Executive act issued by the President with immediate force of law, valid for 60 days and extendable once for 60 days; must be approved by Congress to become permanent, otherwise it lapses.

REDATA – Special tax regime for data center services that suspends specified taxes on qualifying acquisitions and projects meeting technical and sustainability criteria.

Law No. 11,196/2005 – Federal statute that sets technology-incentive regimes; REDATA operates by amending/within this legal framework.

PIS/Pasep – Federal social contributions on gross revenue; under REDATA, payment may be suspended for eligible acquisitions.

Cofins – Federal social contribution on gross revenue; likewise subject to suspension under REDATA when requirements are met.

IPI – Federal excise tax on industrialized products; may be suspended under REDATA for qualifying ICT equipment.

Import Duty (II) – Federal tariff on imported goods; suspension applies under REDATA (typically when no national equivalent exists).

Co-qualification – Administrative mechanism allowing companies contracted to support the project to be jointly qualified under REDATA so their eligible acquisitions also benefit.

Export Processing Zone (ZPE) – Special customs area with its own incentive regime; may coexist with REDATA but has broader benefits and stricter operational obligations.

Water-use concession (outorga) – Government grant authorizing abstraction/use of water resources for project operations when applicable.

WUE index – “Water Usage Effectiveness,” efficiency metric expressed in L/kWh used by Brazilian regulation here to set water-efficiency thresholds for data centers.