Brazilian Federal Revenue Service Tax Directive No. 2,264, issued on 30 April 2025, updates and amends provisions of Tax Directive No. 2,121/2022, which consolidates the rules on calculation, collection, audit, enforcement, and administration of PIS and Cofins contributions. The new directive introduces important regulatory developments aimed at aligning administrative regulations with the case law of Brazil’s higher courts while also addressing taxpayers’ operational and legal demands. Key changes include:

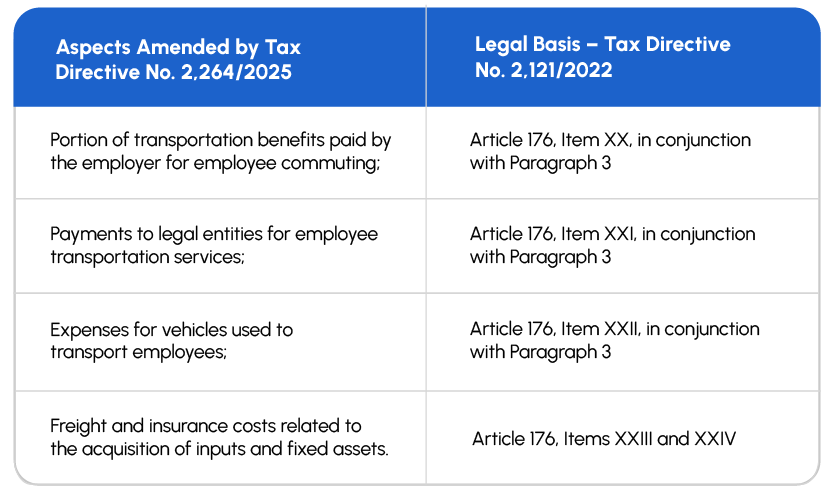

- Express Recognition of Input Costs Eligible for PIS and Cofins Tax Credits: The updated language now explicitly allows companies to claim credits on certain expenses classified as inputs, Aligning the rules with previous interpretations issued in Cosit Rulings (formal tax rulings). The following are now considered deductible inputs:

- Payments to businesses for employee transportation services;

- Expenses for vehicles used to transport employees;

- Freight and insurance costs related to acquiring of inputs and fixed assets.

The directive also amends Items XX to XXII of Article 176 to expressly include the portion of employer-paid transportation benefits related to employee commuting. Additionally, it introduces Paragraph 3, which requires a proportional calculation of these expenses. The calculation must reflect the ratio between employees directly engaged in production or service activities and the total number of employees receiving transportation benefits, applying this ratio to the total amount spent on such services.

- Exemption from PIS and Cofins on Revenues from Resale of Single-Phase Products in the Manaus Free Trade Zone and Free Trade Areas: The new directive introduces a specific exemption for revenues from the resale of products subject to the single-phase tax regime when intended for consumption or industrialization in the Manaus Free Trade Zone (ZFM) or Free Trade Areas (ALCs). The exemption applies to legal entities established in these regions, provided the products are purchased from producers, manufacturers, or importers outside these areas. This change reflects the position adopted by Brazil’s Supreme Federal Court (STF) and confirmed in official opinions from the Office of the Attorney General for the National Treasury (PGFN).

- Offset or Refund of Credits Related to Imports of Goods Resold in the Domestic Market: The directive introduces a new chapter addressing the offset or refund of credit balances arising from the importation of goods subsequently resold in the domestic market. This provision applies retroactively to January 2023.

Tax Directive No. 2,264/2025 represents a major step in consolidating and updating the rules on PIS and Cofins. It strengthens legal certainty and aligns the regulations with the case law of Brazil’s higher courts and the PGFN’s official positions. Key developments include the express recognition of new input costs eligible for credits, the exemption for single-phase product sales in incentivized regions, and the possibility of offsetting or refunding import-related credits tied to domestic resale. Together, these measures help build a clearer, more efficient, and operationally consistent tax environment for Brazilian taxpayers.

Glossary

Supplementary Law No. 214/2025: The Brazilian law that establishes the new tax framework, significantly restructuring the country’s tax system.

PIS and Cofins: Two Brazilian federal social contributions levied on gross revenues, commonly referred to as consumption taxes.

ICMS: The Brazilian state-level value-added tax on the circulation of goods and certain services.

ISS: The Brazilian municipal tax on services.

IPI: The federal excise tax on manufactured products in Brazil.

Corporate Income Tax (IRPJ): The Brazilian federal income tax levied on corporate profits.

Social Contribution on Net Profit (CSLL): A Brazilian federal tax on corporate net profits, calculated alongside the IRPJ.

Contribution on Goods and Services (CBS): A new federal consumption tax introduced under Brazil’s tax reform, replacing PIS and Cofins.

Tax on Goods and Services (IBS): A new consumption tax jointly administered by Brazilian states, municipalities, and the Federal District, replacing ICMS and ISS.

Ancillary Obligations: Additional tax compliance requirements imposed on taxpayers, such as reporting and record-keeping duties.

Input Credit Rules: Regulations governing how companies may calculate and use tax credits on inputs to offset tax liabilities.

Non-Cumulative Tax Regime: A tax system that prevents tax-on-tax effects by allowing companies to deduct taxes paid on inputs from taxes due on outputs.

Tax Directive: A formal regulatory act issued by the Brazilian Federal Revenue Service to implement and interpret tax laws.

Cosit Rulings: Official interpretative decisions issued by the General Tax Coordination Office (Cosit) of the Brazilian Federal Revenue Service.

Manaus Free Trade Zone (ZFM): A special economic zone in northern Brazil offering tax incentives to promote industrial and commercial development.

Free Trade Areas (ALCs): Designated regions in Brazil with specific tax benefits to encourage economic activity.

Brazil’s Supreme Federal Court (STF): The highest court in Brazil for constitutional matters.

Office of the Attorney General for the National Treasury (PGFN): The Brazilian federal agency responsible for representing the government in tax and financial matters.

Tax Infraction Notice: A formal notification issued by the Brazilian Federal Revenue Service to a taxpayer regarding tax violations, often leading to penalties and additional assessments.