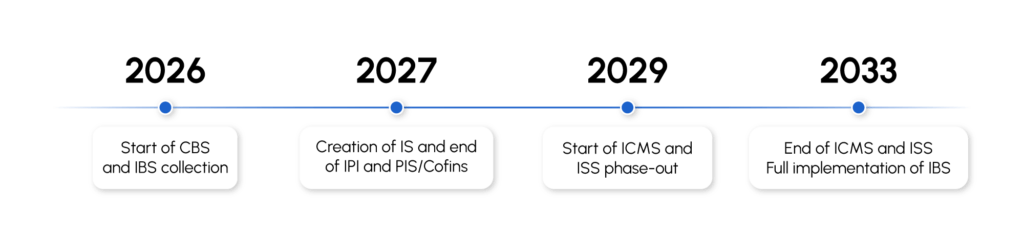

Brazil’s new tax framework, established by Supplementary Law No. 214/2025, represents a comprehensive overhaul of the country’s tax system. The reform introduces structural changes that significantly affect consumption taxes—including PIS, Cofins, ICMS, ISS, and IPI—and ongoing discussions on corporate income taxation (IRPJ and CSLL). Although full implementation is scheduled for 2033, the transition has already begun, making early planning, review, and adaptation essential for businesses.

The new system replaces several existing consumption taxes with two main pillars: the Contribution on Goods and Services (CBS), a federal tax, and the Tax on Goods and Services (IBS), jointly administered by states, municipalities, and the Federal District. This new framework will significantly affect operational, contractual, and accounting flows. During the transition, both models will coexist, requiring compliance with multiple ancillary obligations, specific input credit rules, and new criteria for tax incidence and calculation.

Adapting to the new system will not happen automatically. Companies will need to make both technical and strategic adjustments to their internal tax calculation systems, review pricing policies, and renegotiate contract clauses involving tax pass-throughs.

The CBS and IBS calculation bases will now include all economic charges related to the transaction, including interest, penalties, conditional discounts, selective taxes, and fees. Another key feature of the reform is the shift to a fully non-cumulative tax regime designed to eliminate tax-on-tax effects, separate the taxes involved, prohibit cross-crediting, and establish new rules for credit recognition.

The phase-out of PIS and Cofins will require companies to reassess accumulated tax credits and how they are used, with special attention to transactions under differentiated or single-phase regimes. On the direct tax side, the reform calls for a fresh review of corporate income tax (IRPJ) and social contribution on net profit (CSLL) calculations, especially regarding the legal certainty of deductions, tax incentives, and presumed profit regimes (a simplified profit-based taxation model for small and mid-sized businesses in Brazil). Although specific rules on income taxation will be defined in later phases, their interaction with CBS and IBS impacts requires early risk and opportunity mapping.

At this stage, tax diagnostics are both a preventive and strategic priority. Identifying inconsistencies, mapping high-impact transactions, reviewing special tax regimes, and modeling future scenarios are essential steps to ensure compliance and fiscal sustainability during the transition. Technology readiness will also be critical, as tax calculations will become centralized, using a single registry and a shared platform across federal, state, and municipal levels.

Glossary

Supplementary Law No. 214/2025: The Brazilian law that establishes the new tax framework, significantly restructuring the country’s tax system.

PIS and Cofins: Two Brazilian federal social contributions levied on gross revenues, commonly referred to as consumption taxes.

ICMS: The Brazilian state-level value-added tax on the circulation of goods and certain services.

ISS: The Brazilian municipal tax on services.

IPI: The federal excise tax on manufactured products in Brazil.

Corporate Income Tax (IRPJ): The Brazilian federal income tax levied on corporate profits.

Social Contribution on Net Profit (CSLL): A Brazilian federal tax on corporate net profits, calculated alongside the IRPJ.

Contribution on Goods and Services (CBS): A new federal consumption tax introduced under Brazil’s tax reform, replacing PIS and Cofins.

Tax on Goods and Services (IBS): A new consumption tax jointly administered by Brazilian states, municipalities, and the Federal District, replacing ICMS and ISS.

Ancillary Obligations: Additional tax compliance requirements imposed on taxpayers, such as reporting and record-keeping duties.

Input Credit Rules: Regulations governing how companies may calculate and use tax credits on inputs to offset tax liabilities.

Non-Cumulative Tax Regime: A tax system that prevents tax-on-tax effects by allowing companies to deduct taxes paid on inputs from taxes due on outputs.

Tax Directive: A formal regulatory act issued by the Brazilian Federal Revenue Service to implement and interpret tax laws.

Cosit Rulings: Official interpretative decisions issued by the General Tax Coordination Office (Cosit) of the Brazilian Federal Revenue Service.

Manaus Free Trade Zone (ZFM): A special economic zone in northern Brazil offering tax incentives to promote industrial and commercial development.

Free Trade Areas (ALCs): Designated regions in Brazil with specific tax benefits to encourage economic activity.

Brazil’s Supreme Federal Court (STF): The highest court in Brazil for constitutional matters.

Office of the Attorney General for the National Treasury (PGFN): The Brazilian federal agency responsible for representing the government in tax and financial matters.

Tax Infraction Notice: A formal notification issued by the Brazilian Federal Revenue Service to a taxpayer regarding tax violations, often leading to penalties and additional assessments.