Following new U.S. tariffs on goods imported from Brazil, several Brazilian states are implementing fiscal measures to cushion export-oriented companies.

On 7 May 2025, governors from ten Brazilian states—São Paulo, Minas Gerais, Rio de Janeiro, Paraná, Santa Catarina, Rio Grande do Sul, Goiás, Mato Grosso, Amazonas, and the Federal District—met to assess the economic impact of these tariffs and coordinate state-level responses.

São Paulo’s Fiscal Response

As part of its response, São Paulo State announced:

- Release of BRL 1.5 billion (approx. USD 300 million) in accumulated ICMS (state VAT) credits under the “ProAtivo” program.

- Launch of the Giro Exportador credit line with the state development agency DesenvolveSP, providing BRL 200 million (approx. USD 40 million) in subsidized loans to companies trading with the United States, and raising the cap for eligible companies to BRL 400 million.

What Is ProAtivo?

ProAtivo is a São Paulo State program that improves corporate liquidity by allowing companies to transfer accumulated ICMS (state VAT) credits to other taxpayers in the state. The 12th round is set out in SRE Administrative Ordinance 43/2025 (State Revenue Subsecretariat) and SFP Resolution 22/2025 (Finance and Planning Secretariat).

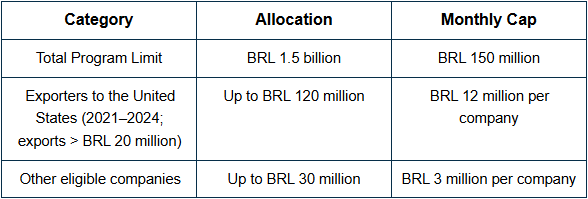

Transfers are scheduled to begin in September 2025, with the following limits:

How to Apply

To participate, companies must:

- Apply between 12 August and 2 September 2025

- Be in good standing with the ICMS taxpayer registry (Cadesp)

- Have an accumulated ICMS credit balance recorded in the e-CredAc system

Additional Support: Giro Exportador

The Giro Exportador credit line offers:

- Interest rates starting at 0.27% per month, plus IPCA inflation (Brazil’s official consumer price index)

- Repayment terms up to 60 months

- Grace period of up to 12 months

- Financing limit of BRL 20 million per company

This initiative aims to help preserve the competitiveness of São Paulo’s exporters amid rising trade barriers.

Glossary:

ICMS (state VAT) – state-level value-added tax in Brazil. In this alert, companies may transfer accumulated ICMS credits to other taxpayers.

ProAtivo – São Paulo State program that authorizes the transfer of accumulated ICMS credits to improve corporate liquidity. The alert refers to its 12th round.

Giro Exportador – state credit line aimed at exporters, offering subsidized loans tied to international trade operations.

DesenvolveSP – São Paulo State development agency that partners with the government to offer credit (including the Giro Exportador line).

SRE (State Revenue Subsecretariat) – São Paulo’s State Revenue Subsecretariat, issuer of Administrative Ordinance 43/2025 cited as part of the legal basis.

Administrative Ordinance – binding administrative act issued by an executive department; used here for SRE Administrative Ordinance 43/2025.

SFP (Finance and Planning Secretariat) – São Paulo’s Finance and Planning Secretariat, issuer of Resolution 22/2025 cited as part of the legal basis.

Resolution – normative act issued by an authority such as a secretariat; used here for SFP Resolution 22/2025.

Cadesp – São Paulo’s ICMS taxpayer registry. Companies must be in good standing to participate.

e-CredAc – digital system that records accumulated ICMS credits. Participants must hold a recorded credit balance.

IPCA – Brazil’s official consumer price index; used here as an inflation component added to the monthly interest rate.